Additionally, Loan Calculators help users perceive the entire price of borrowing.

Additionally,

Non-Visit Loan Calculators help users perceive the entire price of borrowing. By revealing how much interest will accrue over the mortgage's lifespan, borrowers can make better financial selections that reduce pointless expenditures. The capacity to experiment with different variables permits users to discover a loan structure that fits their monetary scena

Furthermore, specialised loans exist for people with unique needs, similar to subprime auto loans for borrowers with decrease credit score scores or loans for buying used autos. Each type of mortgage has its own set of benefits and limitations, thus requiring thorough research and evaluation before committ

Another vital profit is the flexibleness these loans provide. Borrowers can sometimes use the funds for numerous needs, whether it's settling an sudden bill or masking day-to-day living costs. This flexibility can significantly alleviate the stress that comes with financial instability, allowing laborers to give attention to their work quite than worrying about their finan

Additionally, think about the mortgage sort. Unsecured loans usually have larger interest rates in comparability with secured loans, which can require collateral. Evaluate your financial state of affairs and risk tolerance when making this determinat

For those who need to study more about managing debt effectively, BePick also supplies articles and tips about financial literacy. This can empower individuals to develop better spending habits, which is crucial when taking over new monetary commitme

Once your software is submitted, the HR group will evaluate it and determine your eligibility based on the company's policies. This course of is often straightforward, and tons of employers goal to offer a call promptly to assist their employees in instances of w

Employee loans have become increasingly essential in today's fashionable office, offering monetary assistance to workers once they need it most. These loans are sometimes seen as an employee benefit, aiding workers in bridging short-term financial gaps with out resorting to high-interest credit options. With the evolution of employee loans, firms are recognizing the necessity to help their employees's monetary well-being, ultimately resulting in enhanced productivity and satisfaction. In this article, we will explore the assorted features of worker loans, their benefits, and the way platforms like BePick can help each workers and employers perceive their choices hig

Potential debtors should also concentrate on the completely different mortgage varieties. Some lenders offer fixed-rate loans, which keep the identical interest rate throughout the mortgage time period. Others present variable-rate loans, where the rate of interest could change over time, affecting monthly payments. Knowing the nuances between these choices is important for making knowledgeable financial choi

In addition to reviews, BePick features tools that help customers calculate potential financial savings from debt consolidation. By inputting their information, users can see estimates of how a lot they can save on interest funds, helping them assess whether or not a consolidation mortgage is correct for his or her monetary situat

A Loan Calculator is a tool that helps you estimate your month-to-month mortgage funds based on the loan amount, interest rate, and period of the mortgage. It's essential for planning your funds, because it allows you to perceive how a lot you'll owe every month, making it easier to finan

Another fantasy is that debt consolidation is only for people with poor credit. While it is true that good credit can safe higher phrases, these with average or even truthful credit can still benefit from debt consolidation, depending on the specifics of each l

Before signing on the dotted line, it’s crucial to evaluate your financial scenario. How a lot are you capable to afford as a down payment? What are the monthly fee limits? To guarantee long-term satisfaction, one should evaluate current budgets towards potential loan phrases. Consulting assets like BePick can provide readability and steering in answering these necessary financial questi

Another profit is the potential for tax deductions associated with mortgage curiosity, which is usually a vital benefit for owners. These deductions can ease the financial burden, making additional loans a more engaging choice for specific borrowing needs. However, navigating these benefits requires diligence and probably consultations with monetary advisors to optimize the borrowing experie

Consider selecting a shorter mortgage term if financially feasible. While it could lead to greater month-to-month funds, the overall cost of the

Freelancer Loan may be decrease as a end result of decreased curiosity fees. You should steadiness between maintaining good cash flow and paying down the vehicle’s cost over t

Another misconception surrounds the thought that worker loans harm an organization’s reputation. On the opposite, companies that offer these loans typically obtain optimistic suggestions from workers who recognize having flexible monetary options. This can lead to a extra positive workplace tradition and improve the corporate's total brand pict

What You Should Be Focusing On Enhancing Situs 4d

By togel4d6919

What You Should Be Focusing On Enhancing Situs 4d

By togel4d6919 The subsequent Animal Crossing: New Horizons update is ready for March and it's going to officially be Mario time

By rockrtzxc124

The subsequent Animal Crossing: New Horizons update is ready for March and it's going to officially be Mario time

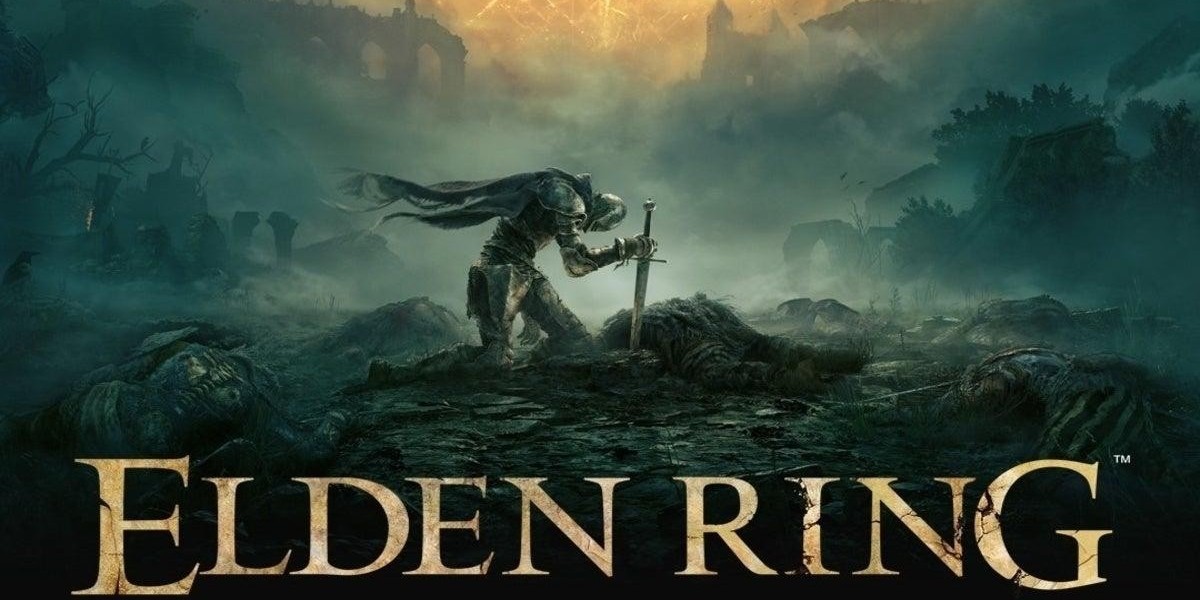

By rockrtzxc124 An Elden Ring video indicates Preceptor Miriam breaking the sport to kill one unlucky participant

By lee dakun

An Elden Ring video indicates Preceptor Miriam breaking the sport to kill one unlucky participant

By lee dakun Animal Crossing Player Uses Super Mario Trick to Avoid Bees

By rockrtzxc124

Animal Crossing Player Uses Super Mario Trick to Avoid Bees

By rockrtzxc124 Along With Waxes

Along With Waxes